commercial real estate Florida market offers diverse and lucrative investment opportunities. With a favorable tax environment, robust economic growth, and strategic geographic location, Florida is a prime destination for investors. This article explores the key factors that make Florida an attractive market for commercial real estate investment and highlights some of the most promising opportunities.

Florida’s Favorable Tax Environment

Florida provides a highly favorable tax environment for investors, with no personal income tax, inheritance tax, or estate tax. These tax benefits significantly reduce the financial burden on investors and enhance the overall return on investment. The state’s business-friendly policies further incentivize investment, making Florida an appealing choice for both domestic and international investors.

Key Markets for Investment

Miami

Miami is a high-yield market with strong foreign investment and a vibrant cultural and economic scene. The city’s strategic location as an international gateway attracts significant capital, particularly in the office and retail sectors. Investors can find lucrative opportunities in downtown Miami and surrounding areas, where demand for commercial spaces remains high.

Orlando

Orlando’s economy is heavily driven by tourism, making it an ideal market for both short-term vacation rentals and long-term commercial investments. The city’s ongoing expansion and population growth create continuous demand for retail and office spaces. Investing in Orlando offers the potential for substantial returns, especially in areas close to major attractions and expanding suburbs.

Tampa

Tampa is known for its corporate headquarters and bustling economic activity. The city’s robust job market and business-friendly environment make it a hotspot for commercial real estate investments. With attractive rental yields and consistent property appreciation, Tampa offers a stable and profitable investment landscape.

Jacksonville

Jacksonville boasts a diverse economy with significant growth in the industrial and logistics sectors. The city’s affordable property prices and strong population growth make it an attractive market for investors. Opportunities abound in industrial parks, office buildings, and mixed-use developments, driven by Jacksonville’s strategic location and economic diversity.

The Role of Foreign Investment

Foreign investment plays a crucial role in Florida’s commercial real estate market. The state ranks among the top destinations in the U.S. For foreign direct investment (FDI), attracting capital from countries such as Canada, Germany, and China. This influx of foreign capital has bolstered various sectors, including office, retail, and industrial properties, particularly in cities like Miami and Orlando.

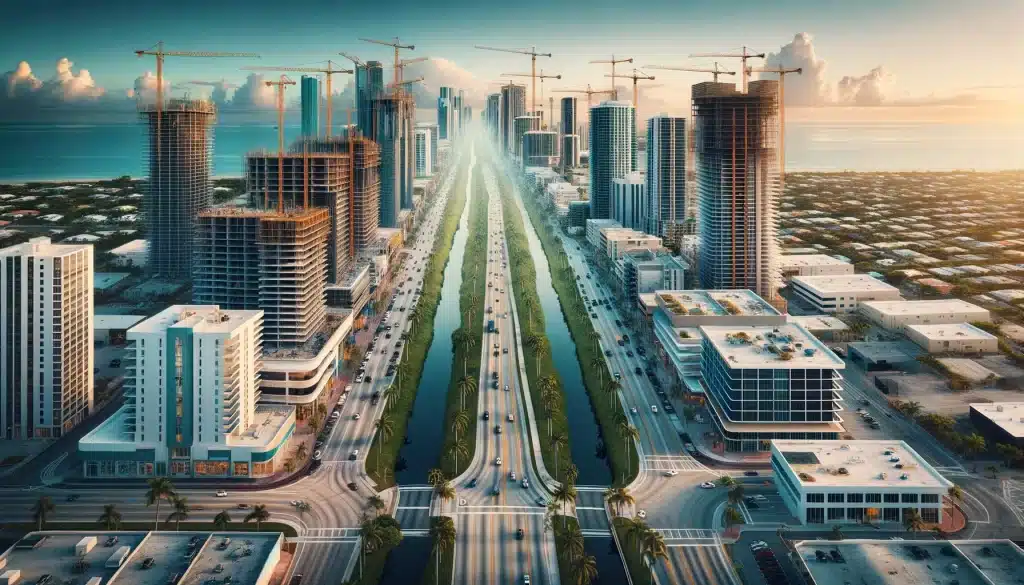

South Florida: A Prime Investment Region

South Florida, encompassing Miami, Fort Lauderdale, and West Palm Beach, stands out as a prime region for commercial real estate investment. The area’s strategic location, robust economy, and high quality of life attract both investors and businesses. South Florida offers consistent property value appreciation and strong rental yields, making it an ideal market for long-term investments.

Effective Investment Strategies

Targeting High-Growth Areas

Focusing on high-growth areas such as Orlando and Tampa is another successful investment strategy. These cities are experiencing robust economic and population growth, driving demand for commercial properties. Investing in expanding neighborhoods and commercial districts in these areas can yield substantial returns as the local economy continues to flourish.

Economic and Job Market Growth in Central Florida

Central Florida, particularly the Orlando area, is witnessing significant economic and job market growth. This growth attracts a steady influx of residents, increasing demand for both residential and commercial properties. The expanding job market and economic development create numerous opportunities for investors in office spaces, retail centers, and mixed-use developments.

Conclusion

Florida’s commercial real estate market presents a wealth of investment opportunities, driven by favorable tax policies, robust economic growth, and strategic geographic advantages. By targeting key markets such as Miami, Orlando, Tampa, and Jacksonville, and employing effective investment strategies, investors can capitalize on the state’s thriving commercial real estate sector. With the potential for high returns and ongoing growth, Florida remains a top choice for commercial real estate investment opportunities.

For more detailed insights on real estate investment opportunities and the commercial real estate Florida, visit Lawrence Todd Maxwell’s Topics and Todd Maxwell’s LinkedIn.